Second Quarter Update 2023

News on ESG and Achieving Impact

Bain Consulting and Ecovadis, an ESG ratings firm, released a joint study finding that ESG related initiatives in business are highly correlated with improved revenues and margins. The study headlines “We found connections between sustainability and business results in the areas of sustainable supply chain, renewable energy, employee satisfaction, and DEI.”

In March, Allied Market Research released an Impact Investing Market analysis and industry forecast. The report highlights that the global impact investing market will grow from $2.5 trillion in 2021 to $6 trillion in 2031, a 9.5% CAGR. Institutional investors like pension funds will drive much of the growth along with high-net-worth individuals and partnerships between non-governmental organizations and government agencies. The website “ImpactAlpha” reported in May that out of 230 impact fund exits analyzed, 42% outperformed expectations, 23% achieved their target, while 35% underperformed. 80% of those funds met their impact expectations showing that positive impact and competitive returns are achievable.

The above graph compares the JUST 100, Fortune Change the World, and Firms of Endearment index performance against the SPX for the five year period from January 1, 2018 to June 30, 2023. Through this period, the JUST 100 and Fortune Change the World indexes closed 20+ points higher than the S&P 500 in the period analyzed. With these indices outperforming the S&P, it helps validate the value these conscious companies are creating for all stakeholders, including shareholders.

Impact Fund Assets Under Management have steadily increased since 2018 with indications that AUM in the impact space will continue to grow. The major hurdles to capital deployment remain vehicle alignment to impact objectives. Climate, air, energy, and infrastructure will likely remain the top impact categories among the 13 other IRIS+ impact categories.

Middle Market Outlook: In the U.S., deal activity has recently slowed due to rising interest rates, the effects of the highest inflation in 40 years, and pricing volatility. Despite these factors, deal flow in 2022 was still above pre-pandemic levels with middle market deals counting for 76.5% of all deals in 4Q22. Looking ahead, inflation is expected to continue its downward trend, rate hikes will abate, and post-pandemic norms will solidify. These expectations lead us to believe middle market deal flow will remain strong in 2023, despite higher-interest rates.

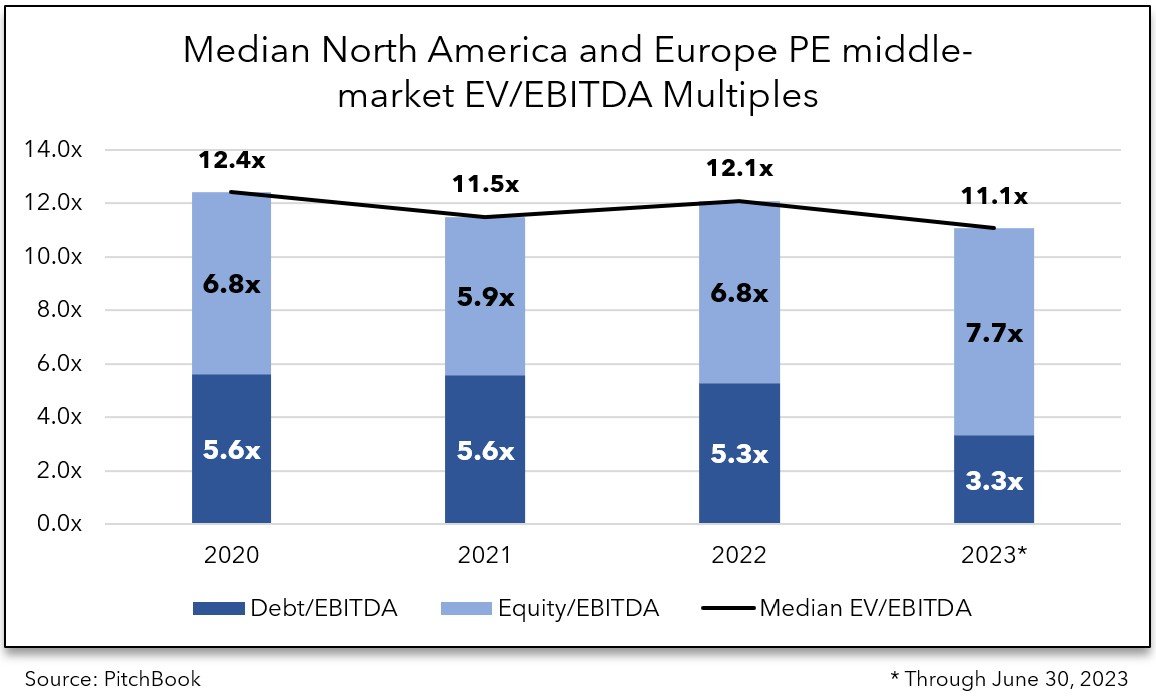

Median multiples declined from 12.1x in 2022 to 11.1x over the last 6-months ending June 30, 2023. This decline reflects the higher interest rate lending environment and is evidenced by the lower overall Debt/EBITDA multiples. We expect this trend to continue with many PE firms contributing more equity capital and negatively impacting enterprise values.