Q3 2021 Review & Outlook

Impact indices continue to deliver higher returns compared to the S&P 500.

Two of the Impact indices we are tracking - Just Capital 100 and Fortune Change the World index - continued to outperform the S&P 500 in overall market value growth from Q3 of 2020 to Q3 of 2021. Only the Firms of Endearment index underperformed the S&P 500 during that same period. Another major development in the public markets is that the Securities Exchange Commission Asset Management Advisory Committee issued a preliminary recommendation that the commission require the adoption of standards by which corporate issuers disclose ESG material risk. The EU has already passed a corporate sustainability reporting directive, which takes effect in 2023.

The private markets are also following the financial industry’s growing interest in ESG. According to a sustainable investment survey by Pitchbook, 43.2% of private equity and venture capital general partners say the events of 2020 and 2021 have shaped their focus on sustainable investing. Furthermore, EY’s 2021 Global Private Equity Divestment Study survey results showed that 72% of general partners expected an “ESG premium” in the exit of a portfolio company that fits the criterion. PitchBook reports seeing more deal announcements across sectors highlighting ESG related advantages. Case in point, Carlisle Companies demonstrated their commitment to making ESG a normal part of their culture through the announcement of their acquisition of Henry Company, a manufacturer of building envelope solutions that control the flow of water, vapor, air and energy. They emphasized how the deal will enhance Carlisle’s construction offerings that can improve energy efficiency for their customers.

Key ESG transactions tracked by PitchBook are as follows:

Blackstone’s acquisition of Sphera, an ESG software, data and consulting service provider for $1.4 billion.

KKR’s minority investment in Sol Systems, a renewable energy solutions firm. KKR committed up to $1 billion to develop and acquire renewable energy and storage projects in partnership with the company.

Apax Funds acquisition of EveryAction, Social Solutions, and Cybergrants to form a $2 billion social impact platform that will allow the companies to scale and improve their services for nonprofit organizations.

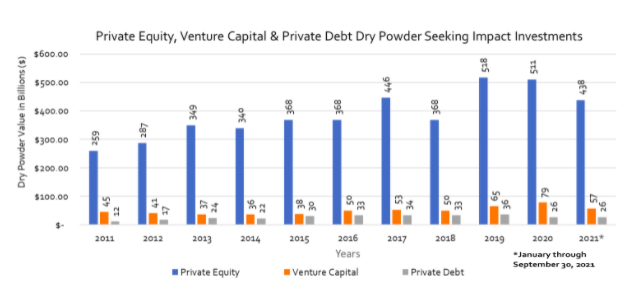

2. US private equity and venture capital funds seeking impact investments are expected to close the year with record levels of dry powder as funds continue to bring in new capital commitments.

Dry powder is expected to reach record levels across all fund types by the end of 2021 as fundraising in Q3 of 2021 continued to bring in new capital commitments at a rapid clip.

Some key funds driving growth in impact investing include:

TPG Rise Climate Fund - raised $5.4 billion in July with a final close expected in 4Q2021 and a hard cap of $7 billion in total capital commitments. This fund was created to expand the scope of commercially viable climate technologies.

Brookfield Asset Management - announced a closing of $7 billion on their Global Transition Fund in July. The company aims to have the largest fund focused on the global transition to a net-zero economy by transforming carbon-intensive businesses to align with the Paris Climate Accords.

MPM Capital - announced in October that it raised $650 million through their partnership with UBS for the biggest biotechnology impact fund ever, bringing total assets under management to $850 million. Oncology Impact Fund 2 will invest 80% of its capital into privately held start-ups, and the remainder into public companies developing innovative treatments for cancer and other serious illnesses.

3. Later-Stage venture capital valuations remained steady, early-stage valuations grew and angel-to-seed had a moderate decline.

Angel-to-seed valuations had a slight decline in Q3 despite completing over 5,000 financings and over $11 billion in deal value. First financings are expected to close the year with record totals for deal value and deal count. High expectations for Q4 of 2021 were reinforced by mega funds, Andreessen Horowitz and Greylock, announcing new seed-focused funds of $400 million and $500 million respectively during Q3.

Early-stage venture capital median pre-money valuations continued grew by 11% in Q3 to $50 million from $45 million in Q2 of 2021. The growth is attributed to competition among investors to identify and fund promising early-stage startups. Furthermore, 44 early-stage mega-deals (those exceeding $100 million) were completed in Q3, which helped to raise average valuations according to PitchBook.

Later-stage venture capital median pre-money valuations in Q3 remained constant at their Q2 highs of $120 million. The expansion of available capital for later-stage venture capital has been a consistent driver behind the growth in deal sizes and valuations since most of the capital entering the VC market has been for mature startups.

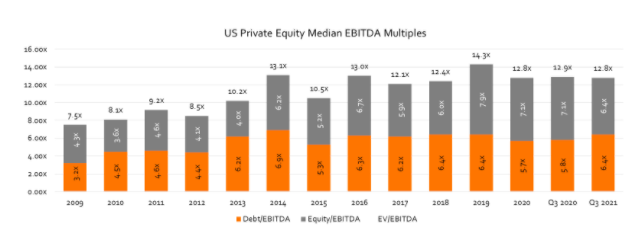

4. US private equity buyout multiples remain steady as private markets continue to recover from the pandemic.

U.S. private equity buyout multiples in the third quarter of 2021 were relatively similar to Q3 of 2020 at 12.8x and 12.9x, respectively. During Q3 of 2020, private equity firms pivoted to traditional buyout activity after initially pursuing distressed and private investment in public equity (PIPE) deals as a reaction to the COIVID-19 pandemic according to Hugh MacArthur, global head of private equity at Bain and Company. In 2021, technology and other asset light businesses are securing the highest multiples in the private markets while travel and entertainment sectors are achieving lower exit multiples despite moderately recovering from their pandemic lows. In addition, PitchBook reports that private equity firms are increasingly exiting to public markets at an aggregate S&P 500 EV/EBITDA multiple of 18.0x, which is 5.2x higher than the Q3 median buyout multiple in the private markets.

5. Middle market multiples remain resilient through the pandemic.

Median EBITDA middle market multiples rose by 23% to 14.9x over the first half of 2021 compared to 12.1x for the same period in 2020. Middle market exits between $100 million and $500 million rose steadily as lower middle market exits ($100 million and under) declined as a proportion of middle market exits overall. Additionally, middle market buyout funds have raised $68.4 billion in Q2 of 2021. Middle market funds are benefitting from investor’s robust appetite for private market exposure.

In a Q2 earnings call, Kewsong Lee, CEO of Carlyle Group, a multinational private equity firm, said “the velocity of virtually all aspects of our business has increased. Deals are being completed on shorter timelines, financings are being executed more quickly, opportunities for exits are presenting themselves sooner, funds are being raised faster than ever before. We are seeing this play out in the middle market as well.”

6. Middle market and mega U.S. Private Equity deals grew in Q3 of 2021

U.S. PE transactions continued to grow in Q3 of 2021 compared to the same period last year. Middle market ($100 million to $500 million) average deal value grew by 41% from $72.4 billion in the third quarter of last year to $102.4 billion for the same period in 2021. Mega deals ($1 billion+) saw the most growth as they more than doubled in average deal value from $27.6 billion in Q3 of 2020 to $65.9 billion in Q3 of 2021.

PitchBook data suggests that the key drivers of deal activity as we head toward the end of the year are continued low interest rates, plentiful capital under management (dry powder) and fears of possible capital-gains increases on the horizon. This has made for a perfect storm of sellers wanting to conclude transactions before the year ends and buyers eager to deploy as much capital as possible, as soon as possible. We’re certainly watching the market for regulatory changes but expect continued private equity activity into the fourth quarter of 2021 as freely flowing capital reigns.

7. U.S. PE exit activity is continuing to increase at a record-setting pace.

U.S. PE exit activity was up across all exit types in Q3 of 2021, more than doubling in total exit value to $214 billion compared to $82.1 billion last year during the same period.

PitchBook research suggests that multiples in many sectors increased at a rapid rate over the past 18 months, incentivizing general partners to monetize holdings sooner than they originally anticipated at attractive valuations. Corporate acquirers have been sitting on trillions of dollars in cash on their balance sheets and are writing sizeable checks for PE backed companies. In addition, sponsor-to-sponsor deals are accounting for a greater proportion of PE exits than in previous years.